Venture philanthropy applies most of the same principles of venture capital funding to invest in start-up, growth or risk-taking social ventures. It is not explicitly interested in profit but rather in making investments which promote some sort of social good. Venture philanthropy ventures generally focuses on building capital and scale. It is an umbrella term that can be used to refer shorthand to many different kinds of philanthropic investing, but notably, it is distinct from impact investing, which places more emphasis on turning a profit while nevertheless investing in ventures that address social concerns.

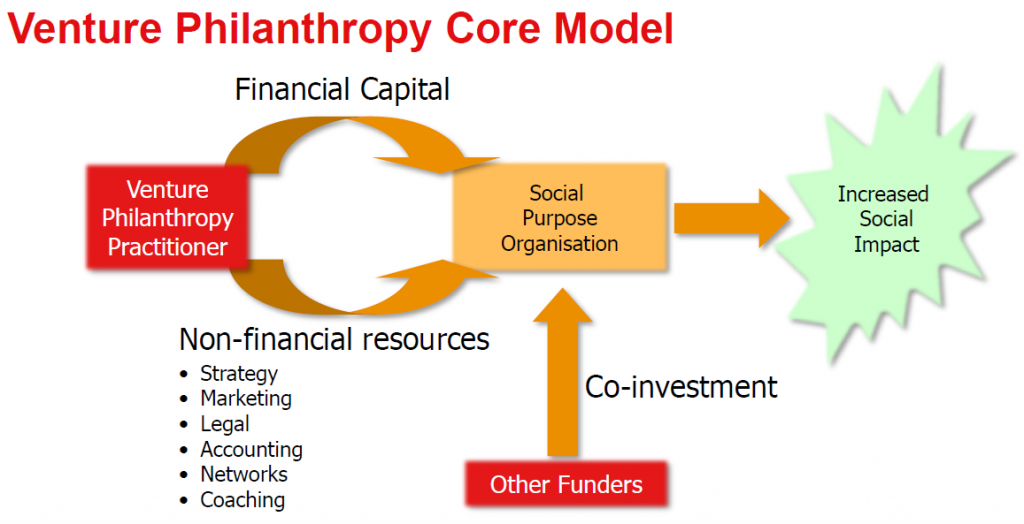

Venture philanthropy is characterized by a high degree of investor oversight and engagement, in addition to financing plans which are tailored very specifically to a company or organization's capacity-building needs. Oftentimes major donors will sit on the boards of organizations they support and they generally have intimate involvement in operational or managerial aspects of the business. They will also provide non-financial support, like offering executive advice, marketing the initiatives using their own platforms and measuring performance. Strategically, most of these practices are drawn from successful venture capital initiatives but judge the efficacy of the organization on standards like overall social impact which depart from usual standards of a successful venture capital investment. (See also: Impact Investing vs. Venture Philanthropy."

This kind of investment takes many forms. These include private foundations owned or supported by wealthy individuals (like theBill and Melinda Gates Foundation), government or university grants designed to support philanthropic endeavors, philanthropic investing arms of major investing institutions, or charities which encourage large or institutional donations. In the United States, most investment is grant-based. This usually results in selective, carefully-chosen multi-year grants, the high competition for which is said to encourage innovation.

Origins of Venture Philanthropy

The term was originally coined by John D. Rockefeller III in 1969, who described it as "an adventurous approach to funding unpopular social causes." The Rockefeller Foundation remains a leading outlet for socially-attuned investing. Venture philanthropy arose largely as a result of a growing public impression that traditional financing mechanisms (investments, government or university grants, etc.) rarely assisted non-profit organizations or other socially beneficial industries build capital. Venture philanthropy has been on the increase in recent years, especially as awareness of climate change and environmental degradation have risen to the forefront of public concern. However, it is showing signs of ceding dominance in the philanthropic investment sphere to impact investing, which is concerned with making a profit while being socially responsible. Cap-and-trade emissions markets or subsidies granted to sustainably-operating businesses are bridging the gap between the market's drive for profit and the philanthropic concern for socially responsible business practices.

Source:- Investopedia

No comments:

Post a Comment