Letter of Credit/Documentary Credit is a one of the method of payment through which payment in the international as well as domestic market is effected for the goods purchased or service provided. Though there is a minor difference between Letter of Credit and Documentary Credit, many times words Letter of Credit and Documentary Credit are used interchangeably.

Letter of Credit/Documentary Credit both play a vital role for providing guarantee by the Banker of the buyer of the goods or receiver of the service to the seller of the goods or provider of the service to pay the money to the seller of the goods or provider of service for which Letter of Credit/Documentary Credit is issued if and only if the terms and condition mentioned in the Letter of Credit/Documentary Credit are fully complied with.

Notwithstanding that, Letter of Credit/Documentary Credit both plays a role for providing guarantee for payment but none of them falls in the definition of Bank guarantee because, there is main difference between the Letter of Credit/Documentary Credit and Bank guarantees the difference is as under:

In case of Letter of Credit/Documentary Credit payment is made only and only if the terms and condition mentioned in the Letter of Credit/Documentary Credit are fully complied with whereas in case of Bank Guarantee payment is made only and only if the terms and condition mentioned in the Bank guarantee are not fully complied with.

In the International and domestic market the Letter of Credit/Documentary Credit are governed by Uniform Customs Practices for Documentary Credit (UCPDC).

Letter of Credit ( LC):

LC is a letter issued by the banker of the buyer or service receiver (called applicant)infavour of the seller or service provider (called beneficiary) to make payment to wards value of the goods bought or services received only and only if the conditions mentioned in the LC are fully complied with.

Documentary credit (DC):

DC is nothing but it is a letter of credit the difference is when the LC requires the beneficiary of the credit to submit certain documents like invoice, packing list Bill of lading or Air way bill other transport documents etc., along with any other documents prepared in compliancewith the terms and conditions of the LC for claiming of payment under the LC, such LC is calledDC.

Numbers of Parties in LC/DC

There are main three parties in LC or DC as under:

i. Buyer

ii. Seller and

iii. Buyer’s baker (which is known as LC/DC opening bank)

Types of LC/DC

There are following types of LC/DC

1. Back to back

2. Closed

3. Confirmed

4. Deferred (Usance)

5. Irrevocable

6. Revocable

7. Revolving

8. Sight

9. Straight

10. Transferable

11. In land

12. Stand by

For the purpose of convenience LC or DC is here called as Credit.

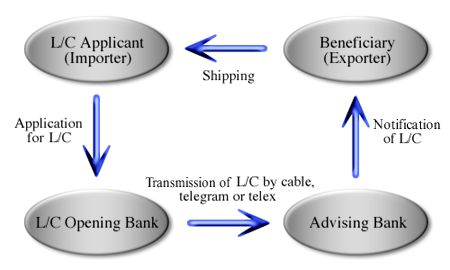

How to Open Credit

Credit can be opened with any bank with which the applicant is having bank account. The bank will charge for opening of LC and also take margin money as security.

How a DC will work

As per the request of the applicant the opening bank will open a Credit in favour of the beneficiary. After supply of the goods or providing of service strictly as mentioned in the Credit he will prepare Credit documents strictly as per the term and condition of the Credit and submit the documents his banker or to the bank as mentioned in the Credit. The banker of the supplier will submit the documents to the Credit opening bank as per the terms of the Credit for effecting the payment. The Credit opening bank will remit the money as per the Credit to the beneficiary’s bank if and only if the documents submitted by the beneficiary are strictly as per the Credit. The Credit opening bank will in turn debit the money remitted to the account of the Credit applicant.

Irrevocable Letter of Credit

Irrevocable letter of credit means the credit which cannot be cancelled or amended without consent of the beneficiary of the credit and the opening bank has to honor the credit if the documents under the credit are strictly in the line of the credit.

Revocable Letter of Credit

Revocable Credit is not widely acceptable credit as the applicant can cancel or amend the credit at any time without the prior consent or information of the credit beneficiary. However the applicant cannot cancel or amend the credit if the shipment is effected. With this credit a risk of uncertainty is involved hence this credit is not widely acceptable. Usually this type of credit is accepted in the African Countries.

Stand By Letter of Credit (SBLC)

Stand by Letter of Credit works as a Guarantee. The suchCredit is issued to secure any transaction with a condition that if that transaction which is entered into or to be executed is not completed within the stipulated period the letter of credit will be invoked and the value of the transaction will be paid thereby.

Revolving Letter of Credit

Revolving Credit means a letter of credit in which value and quantity of the goods are reinstated in the credit after effecting every shipment and realization thereof.

Back to back Letter of Credit

Back-to-Back Letter of credit is the credit, which is opened on the back of the other credit. This type of credit is very helpful for the exporter who has no fund to buy materials for export. In such case the exporter will receive credit from the foreign buyer and on the same terms and condition he will open another credit in India or abroad to buy the materials for effecting the first export shipment. The payment terms of the back-to-back credit will be slight later than the due date of payment of the first credit so that the buyer / exporter can pay the back-to-back credit from the money received from the first original credit.

Credit at Sight or Sight Credit

Sight credit means the credit in which payment is remitted within four days from the date of receipt of the documents by the credit issuing bank if and only if the documents submitted under the credit are strictly as per the credit terms and conditions.

Differed Credit or Usance Credit

Where in any credit the terms of payment is like payment will be made after some days from the date of shipment suppose in any credit the payment terms is 90 days after shipment date or date of shipment such credit is called usance or differed credit.

Confirm Credit

Generally, letter of credit is issued as non-confirmed credit. If the beneficiary of the credit wants to confirm the credit through any bank he will have to pay charges for the confirmation. The confirmation of a credit means the credit confirming bank confirms that the confirming bank will make payment to the beneficiary of the credit if the documents under the credit are strictly as per the terms and condition of the credit and whether the credit confirming bank will receive payment from the credit issuing bank or not.

Here if there is any discrepancy in any of the document submitted under the credit the confirmation will be void.

The confirming bank will inform the credit-issuing bank that the bank is going to confirm the credit. In the case of confirmation the documents under the credit are submitted through the confirming bank even if the confirming bank is not negotiating bank.

Red Cross Credit

In case of a credit in which there is a clause for giving advance against the shipment to the beneficiary of the credit against the credit. In such credit the said clause is not in the red ink, however, it will be called Red Cross credit.

Strait Credit

In any credit only one document is called for submission for effecting the payment it will be called strait credit.

Restricted Credit

In any credit name of the bank for availability of payment is mentioned, in such case the documents under the credit will have to be forwarded through the said bank only. This type of the credit is called restricted credit.

Transferable Credit

Transferable credit means the credit, which can be transferred to others by an endorsement of transfer on a separate letter of transfer. In transferable credit the credit itself bears a clause that ‘this credit is transferable’. In this type of credit transfer letter is required along with the credit without that the credit would not be transferred.

In land Credit

Where in any credit applicant and beneficiary both are of the same country such credits is called as inland credit.

Note: This Article Does Not Belong To Us. For Sharing Knowledgeable Information We Have Taken This Article From Other Site.

Author: Malay M Pota

No comments:

Post a Comment